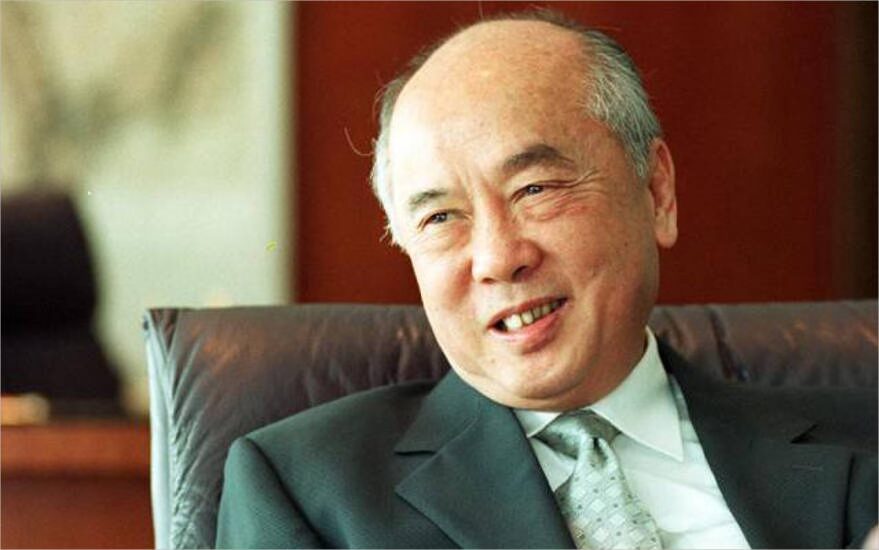

Billionaire Wee Family’s UOB Hits Record High Amid Share Buyback Plans

Singapore — United Overseas Bank (UOB), controlled by Singapore’s billionaire Wee family, has surged to record highs in the stock market following the bank’s announcement that it is considering a share buyback program to enhance shareholder returns. The move highlights UOB’s strong financial position and signals optimism in Singapore’s banking sector.

The bank’s shares climbed over 4% in trading on Thursday, hitting an all-time high of S$32.50. This increase adds to UOB’s impressive 15% gain this year, outpacing the benchmark Straits Times Index. Analysts attribute the rise to the bank’s solid earnings, robust capital buffers, and a buoyant outlook for Singapore’s financial sector.

Share Buyback Plans

The share buyback, still under evaluation, could involve the bank repurchasing a significant portion of its outstanding shares, effectively reducing the float and boosting earnings per share. Such moves are seen as a way to reward existing shareholders while underscoring the bank’s confidence in its long-term growth.

“This reflects our commitment to delivering value to shareholders and our confidence in UOB’s continued resilience and performance,” said Wee Ee Cheong, UOB’s Deputy Chairman and CEO, in a statement. He is a second-generation member of the Wee family, which holds a controlling stake in the bank through their private investment firm, Kheng Leong.

Resilient Financial Performance

UOB, one of Singapore’s three major banks, has shown resilience despite global economic uncertainties. Its strong performance is bolstered by rising interest rates, which have boosted net interest margins, and steady growth in its wealth management and digital banking services. In the most recent quarter, UOB reported a 27% year-on-year increase in net profit, driven by higher income from loans and fee-based activities.

The bank has also been actively expanding its regional footprint, particularly in Southeast Asia, capitalizing on growing markets like Indonesia, Vietnam, and Thailand.

Wee Family’s Legacy

The Wee family is one of Singapore’s wealthiest, with a net worth exceeding $6 billion, according to Forbes. UOB, founded in 1935, has been a cornerstone of the family’s wealth and influence. Under the leadership of Wee Ee Cheong, the bank has continued to thrive and adapt to changing market dynamics, while maintaining its reputation as a stalwart of Singapore’s financial system.

Market Reaction

Investors and analysts have largely welcomed the potential buyback program. “It’s a smart move given UOB’s strong capital position and limited immediate opportunities for major acquisitions,” said Kelvin Wong, an analyst at OANDA. “It shows the bank’s focus on maximizing shareholder value.”

With UOB setting new records and exploring innovative strategies, the Wee family’s legacy continues to grow stronger. Market watchers will be keenly awaiting further details on the bank’s buyback plan, which could set a precedent for Singapore’s banking industry.