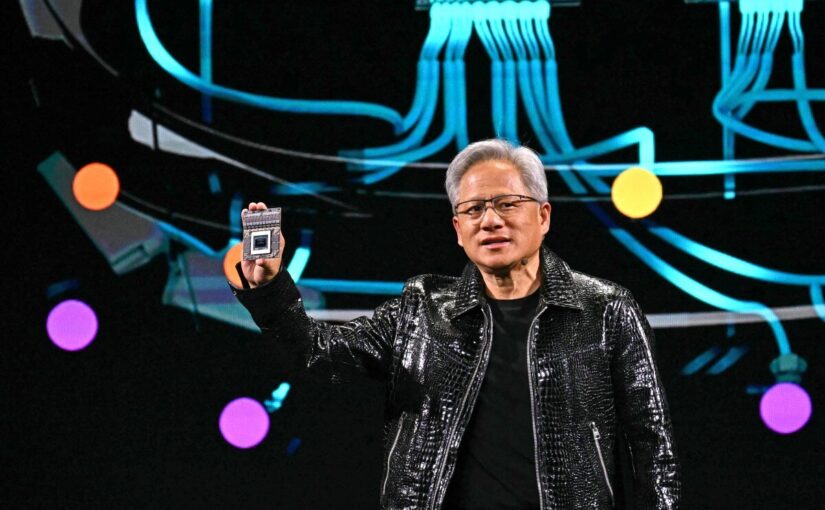

Nvidia Stock briefly touched a new record Tuesday following a high-profile speech from its billionaire leader Jensen Huang, an address teasing the next big thing in artificial intelligence which also inspired rallies from the stocks of several other companies in Nvidia’s orbit, but failed to sustain a prolonged rally for Nvidia.

Key facts

- Nvidia Nvidia stock rallied as much as 2.5% to a new intraday all-time high of $153 shortly after market open, coming on the heels of Huang’s Monday evening keynote at the CES 2025 conference, before turning negative as trading progressed amid a broader technology stock selloff, falling nearly 5% to below $143 by late morning.

- That loss, which would make Tuesday the worst day for Nvidia stock’s since Sept. 3, comes despite an overwhelmingly positive reaction from Wall Street analysts on the the speech largely focused on Nvidia’s efforts in robotics, or physical AI, in addition to advancements in its graphics processing units used for gaming.

- Nvidia showed Monday it “continues to enhance and develop both AI hardware and software offerings that will help maintain its AI leadership as the market transitions to physical AI,” remarked Rosenblatt analyst Hans Mosesmann in a note to clients.

- Huang’s speech also unveiled a variety of new or enhanced partnerships with other major companies for Nvidia, including naming data storage firm Micron as Nvidia’s memory partner for its gaming GPUs and a trio of deals in the space of autonomous driving, perhaps the clearest application of physical AI.

- Huang said Nvidia will supply the semiconductor chips for Toyota’s driver assistance programs and announced it will provide the technology powering the self-driving trucks of Colorado-based Aurora, while ride-hailer Uber said it will use Nvidia’s Cosmos physical AI platform to power its own autonomous driving initiative.

- The “string of announcements, at a minimum, highlight the company’s ability to innovate at industry-leading speed across hardware and software as well as its robust partner and customer eco-system,” noted Goldman Sachs analysts led by Toshiya Hari.

Tangent

Shares of Aurora gained about 40% to their highest level since early 2022, while the stocks of the more established Micron (up 6%), Toyota (2%) and Uber (1%) also enjoyed notable gains.

Crucial quote

“The ChatGPT moment for general robotics is just around the corner,” Huang declared Monday, referring to the 2022 release of OpenAI’s ChatGPT chatbot which sparked intense public interest in generative AI.

Key background

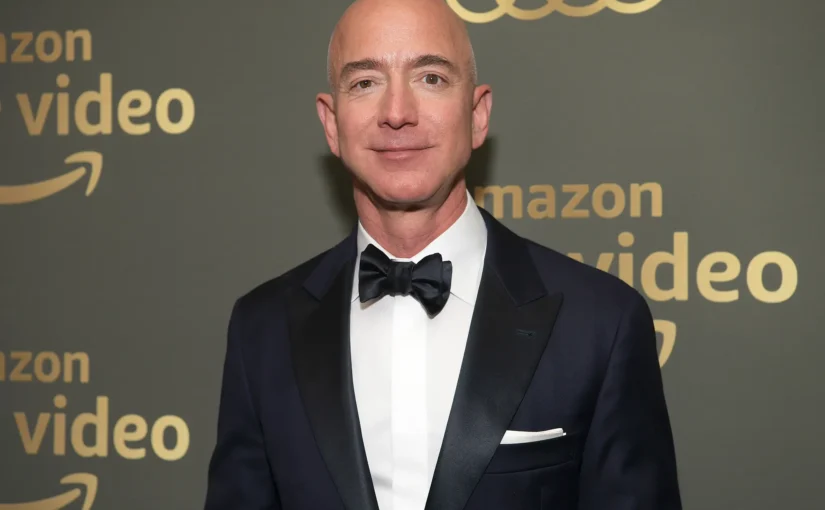

Huang highlighted Nvidia’s “continued dominance in genAI compute and ecosystem, quickly expanding from the cloud all the way to enterprise and consumers,” wrote Bank of America analysts led by Vivek Arya in a Tuesday note. Nvidia is the unquestioned leader in designing the hardware and software architecture needed to power advanced AI, and its non-automaker customers include the likes of Amazon and Microsoft. Long known for its video game graphic efforts, Nvidia rose to the national stage as generative AI captured the attention of the public and Wall Street alike. Nvidia stock is up more than 2,000% over the last five years.